Submitted by Storey & Associates on September 18th, 2018

Ten years ago, the Internal Revenue Service proposed regulations that would define how to value (and prove the actual value) of non-cash donations to charity. The regs involved things like artwork, jewelry and other possessions whose value is often in the eye of the beholder.

Submitted by Storey & Associates on September 11th, 2018

Submitted by Storey & Associates on September 4th, 2018

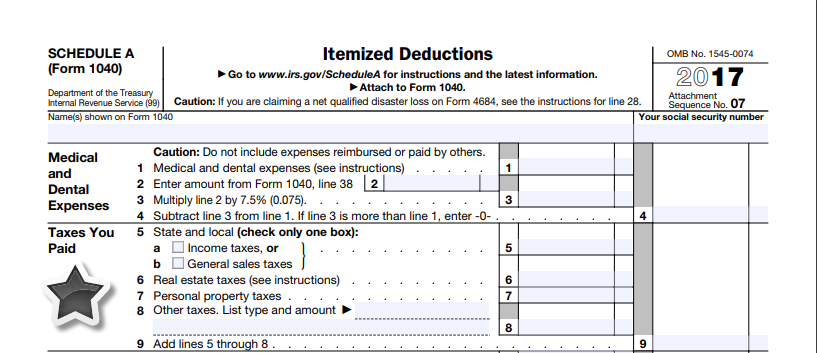

By now, you probably know all about the so-called SALT (state and local tax) deduction limitations imposed by the Tax Cuts and Jobs Act. If your property, local and state taxes exceed $10,000 (couples) or $5,000 (singles), well, too bad. That’s all you can deduct on your federal tax returns.

Submitted by Storey & Associates on August 30th, 2018

Quick: What’s America’s national savings rate? A generation ago, you might have guessed 10% and been pretty close to the market. More recently, there has been a lot of hand-wringing about a precipitous decline in how much of their income Americans are saving—down, according to the U.S.

Submitted by Storey & Associates on August 30th, 2018

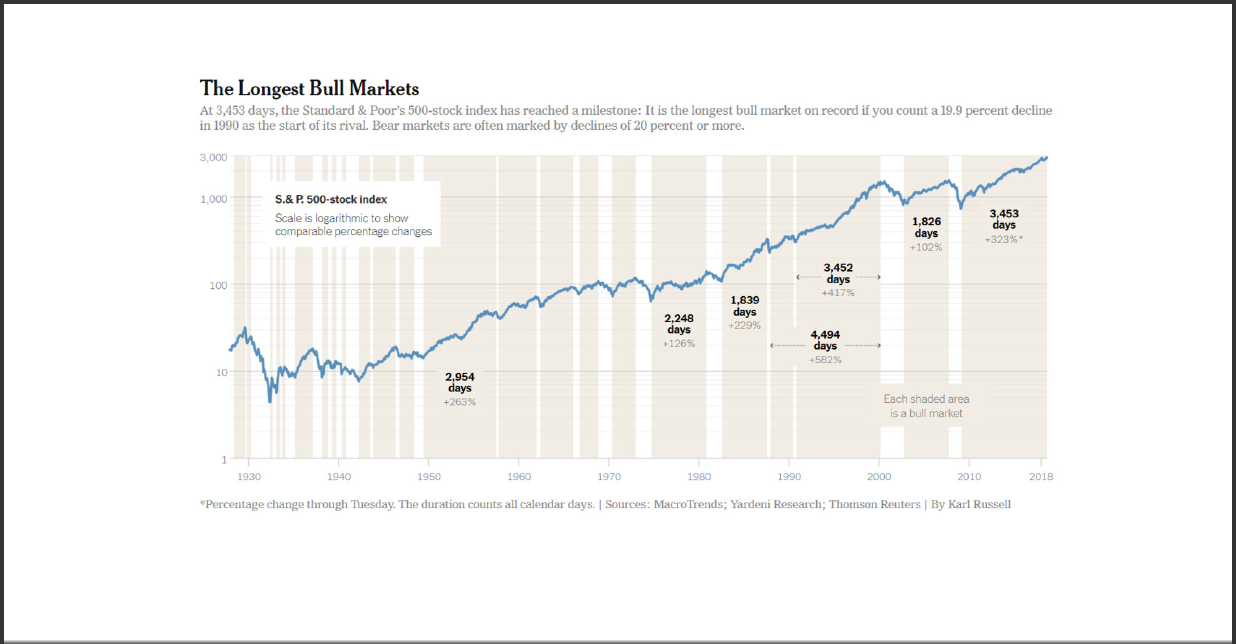

You can be forgiven for wondering what all the hoopla was about when, on August 22, the newspapers erupted with the announcement that the current bull run in the U.S. stock market was the longest in history. Wasn’t the day before and the day before that part of that run?

Submitted by Storey & Associates on August 14th, 2018

Technology for health is finally moving beyond the Fitbit and counting your steps, to more complicated feedback like improving your posture and correcting your running stride.

Submitted by Storey & Associates on August 14th, 2018

Technology for health is finally moving beyond the Fitbit and counting your steps, to more complicated feedback like improving your posture and correcting your running stride.

Submitted by Storey & Associates on August 8th, 2018

People who are contemplating divorce could be surprised by some provisions of the new tax law—and should be including it in their separation plans. The new laws affect the taxation of alimony payments, and also the valuation of certain assets that are usually part of a divorce agreement.

Submitted by Storey & Associates on July 31st, 2018

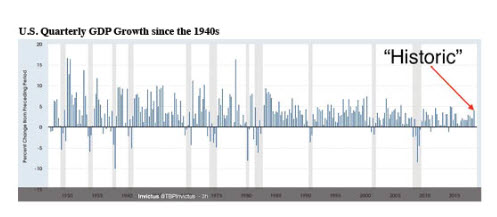

Recent reports about the U.S. economy were a case of good news and bad news. The good news is that, in the second three months of the year, the U.S.

Submitted by Storey & Associates on July 25th, 2018

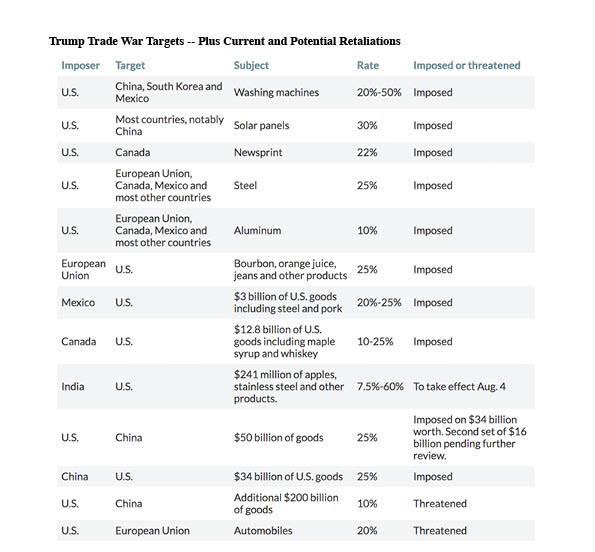

Recently, there has finally been some evidence that the investment markets were starting to get jittery about the escalating tit-for-tat tariffs and threats of tariffs that some economists are calling “America vs. the World.” Most investors are probably wondering whether new taxes on items flowing into and out of the U.S. really is something to worry about.

330-526-8944

330-526-8944  info@storeyassociates.com

info@storeyassociates.com