Submitted by Storey & Associates on July 18th, 2016

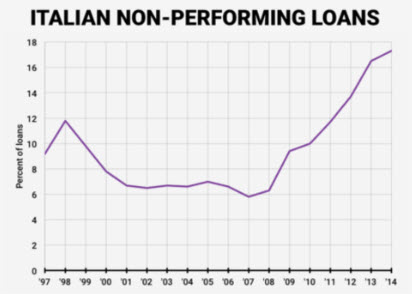

The Next Big Thing to Worry About that you’ll soon be reading about in the financial press is Italian banks. Some Italian banking stocks fell more than 30% after the Brexit vote on fears that the Eurozone will experience weaker-than-expected economic growth. Worse: the Italian banking system now reports that nearly $400 billion worth of its collective loans are nonperforming&m

Submitted by Storey & Associates on June 27th, 2016

Thursday's vote by the British electorate to end its 43-year membership in the European Union seems to have taken just about everybody by surprise, but the aftermath could not have been more predictable. The uncertainty of how, exactly, Europe and Britain will manage a complex divorce over the coming decade sent global markets reeling. London’s blue chip index, the F

Submitted by Storey & Associates on June 6th, 2016

You’ve probably heard that the Bureau of Labor Statistics (BLS) Employment Report for the month of May was disappointing. Economists who follow job growth in the U.S. economy were expecting 123,000 new jobs to be created. The actual number, according to the BLS, was 38,000—the smallest gain since September of 2010.

Submitted by Storey & Associates on May 17th, 2016

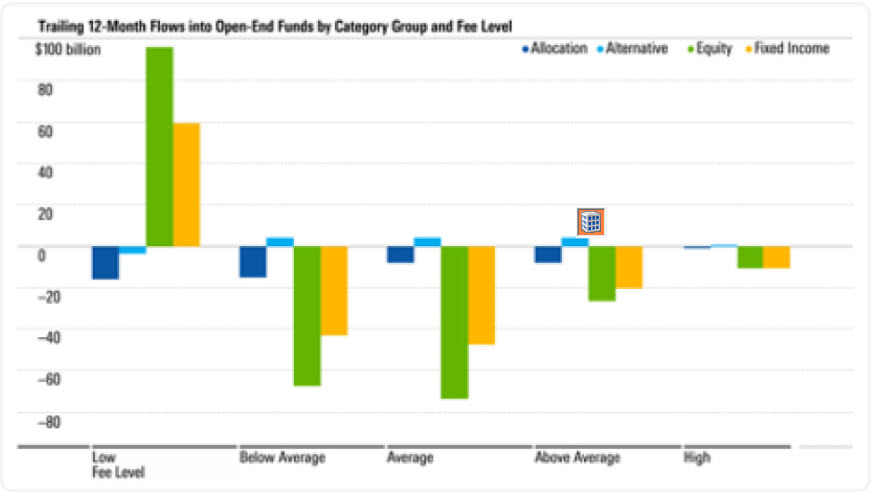

The average investor isn’t stupid. The latest evidence comes from a look at where investors are putting their money, taken by the Morningstar mutual fund data organization.

Submitted by Storey & Associates on May 12th, 2016

The big question in Europe this year is how the British people will vote on June 23. Will they vote to leave the European Union (what’s being called the “Brexit”) or decide to continue to be part of the 28-nation economic alliance?

Submitted by Storey & Associates on April 12th, 2016

We all know that money can’t buy you happiness, right? As it turns out, this is not exactly true.

Submitted by Storey & Associates on April 7th, 2016

.png)

You read a lot about job creation and governmental policies, especially in this era of lingering, lagging economic growth, especially from political figures who are hoping to get elected based on their policy prescriptions. Republican candidates like to talk about the growth of jobs during Ronald Regan’s presidency, while Democrats tout the presidential terms of Bill Clinton.

Submitted by Storey & Associates on March 31st, 2016

Your family has outgrown their current home and it is time to explore the real estate market. To make an educated decision regarding how much you can spend on a home, two ratios are key, the “Basic Housing Ratio” and the “Broad Housing Ratio”.

Submitted by Storey & Associates on March 21st, 2016

Most people have seen bogus emails purported to be from the executors of the estate of Nigerian princes or other obscure foreign notables who want to give them millions of dollars, and sometimes they get bogus calls telling them they can win a lottery sweepstakes or receive debt relief.

Submitted by Storey & Associates on March 15th, 2016

ETFs and index mutual funds are emerging as the investment of choice for investors who are discovering the virtues of passive investing. Not surprisingly they have both seen an explosion of growth and are especially popular choices for retirement plans and investors with a long time horizon.

330-526-8944

330-526-8944  info@storeyassociates.com

info@storeyassociates.com