Submitted by Storey & Associates on March 10th, 2016

.jpg)

With the higher exemptions, you no longer have to plan for your estate, right? Wrong.

Submitted by Storey & Associates on February 23rd, 2016

Submitted by Storey & Associates on February 18th, 2016

.jpg)

There’s no question that we experience emotional pain and anxiety when our portfolios are losing money due to market downturns. Behavioral scientists tell us that we feel losses twice as keenly as positive returns.

Submitted by Storey & Associates on February 10th, 2016

Oil prices are getting all the blame for the recent U.S. stock market downturn, but it’s hard to see the connection when so many companies and consumers benefit from low energy costs. A better culprit is the strong dollar.

Submitted by Storey & Associates on February 3rd, 2016

After the recent downturn in the U.S. and global stock markets, you can be pardoned if you wished that the markets were a bit tamer. Wouldn’t it be nice to get, say, a steady 4% return every year rather than all these ups and downs?

Submitted by Storey & Associates on January 20th, 2016

.jpg)

Wow! There’s no diplomatic way to say this: the global stock markets are in panic mode right now. In two weeks of trading, the U.S. S&P 500 index is down 8% on the year, which brings us close to correction territory (a 10% decline), and has some predicting a bear market (a 20% decline).

As more Americans shoulder the responsibility of funding their own retirement, many rely increasingly on their 401(k) retirement plans to provide the means to pursue their investment goals. That's because 401(k) plans offer a variety of attractive features that make investing for the future easy and potentially profitable.

Submitted by Storey & Associates on December 16th, 2015

We will almost surely see the U.S. Federal Reserve Board start the long process of ending its intrusion into the interest rate markets, by allowing rates to rise starting on Wednesday. It will be the first time the Fed has raised rates since 2006, and for some it will mark the beginning of the final chapter of the Great Recession.

Submitted by Storey & Associates on December 3rd, 2015

You may have read that Facebook founder, chairman and CEO Mark Zuckerberg has announced plans to gift substantially all of his Facebook stock to a philanthropic entity called the Chan Zuckerberg Initiative, named after himself and his wife Priscilla Chan. The gift would be worth $45 billion, instantly becoming one of the largest philanthropic pools in the world.

Submitted by Storey & Associates on November 24th, 2015

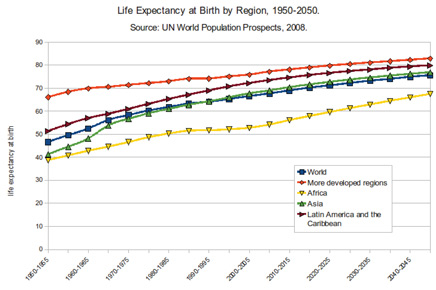

Happy thoughts as we approach the holidays...you may be fifteen years younger than you think you are!

330-526-8944

330-526-8944  info@storeyassociates.com

info@storeyassociates.com